I’ll be the first to admit that budgeting and paying off debt is not for the faint. And quite frankly, so is being an adult, lol. However, mistakes are part of the process and I’d be a fool to say that they aren’t.

Lesson one: There is POWER in your tithe and this is for those who believe. In the book of Proverbs, chapter 11 verse 24, the Word says, “One gives freely, yet grows all the richer; another withholds what he should give, and only suffers want.” Now listen, I was NOT always a consistent tither. I often had meetings with God and tried to reason with Him about why I “needed” to keep my 10%. “Lord God, I can pay almost two utility bills with this.” And God simply showed me his “Oh okay” response. When I made the intentional decision not to tithe, I lost big. What do you mean “lost big?” What I would have paid in my tithe, I was paying that plus more for unexpected things, like car breakdown, etc. It happened like clockwork. Once, I realized that God was convicting me, I became an intentional tither. I tithe without hesitation, cheerfully. And when I tell you, you’ll begin to see God make ways out of no ways or the peace you have in knowing that no matter what may arise, He’s already worked it out and that your cup will never run dry.

Lesson two: You need an accountability partner. There’s a quote that I have written down in my budget planner. “Surround yourself around those who force you to do better.” And that’s exactly what I did. The financial goals were written out and the plan in place had to be aligned with the goals. I talked with my daughter about the changes we needed to make to achieve the goals for our family. My daughter?? Yes, it was important to get her on board as well as other family and friends. And believe it or not, she would say sometimes, “Mommy, we don’t need that,” specifically in Target, lol. Y’all, it’s something about that red dot. Having a discussion with close family and friends was essential and no, not everyone will be on board. But that’s okay. And oh yeah, I have a sister/friend who became debt free this year; only her mortgage is left. Won’t He Do It!

Being on a budget doesn’t mean that you are “broke” or “have no life.” It simply means that you are taking control of your finances, telling your money where to go, and making temporary adjustments that will improve your lifestyle. Here are a few explains of the things we implemented:

- Friday Pizza Night- when we go to the grocery store, we always pick up a ready to bake pizza and salad mix. Aldi has family size pizzas, ranging from $4.99 to $6.99. Salad mix is usually under $2, unless you’re going organic.

- Mani and Pedi at home. I purchased a Conair Foot Spa from Walmart on sale. Great way to have quality time or self-care at home. Now don’t get me wrong, we do like our pedicures done at the salon and we budget/plan for them.

- Hair at home. Braiding was my side hustle in high school and college. I’ve found myself using this gift often for myself and daughter. Saving money, looking nice, and having mom/daughter quality time.

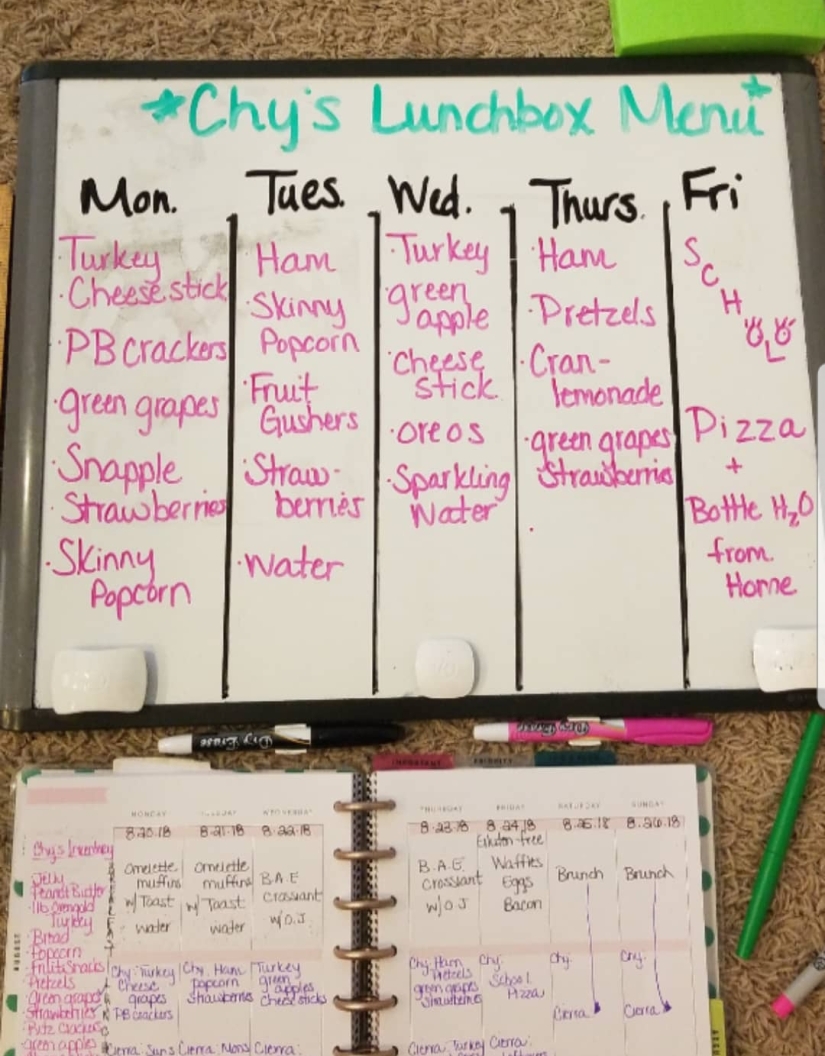

Lesson three: We LOVE food. We’re a household of two, one adult and one child. However, every month I have found that we go over our food budget or barely make it by the hem of Jesus’ garment. MEAL PLANNING has been a life saver for us, in addition to using the discounts available to our area. With meal planning, I’ve cut our grocery budget down, become intentional about not wasting food, and just the simple fact of cooking more at home. In regards to the discounts on meals in our area, here are a few examples. Zaxby’s has $0.99 kids meals on Wednesdays from 5-8pm with the purchase of a regular meal. Low Country Shrimper has FREE kids meals on Tuesdays after 5pm with a purchase of an adult meal. On these days, we implement them in our meal plans.

Budgeting hasn’t been an easy cake walk! Each month, I’ve learned something new. But you should make the decision to BE INTENTIONAL about your finances. Don’t wait until 2019 to prepare, the time is now. Just like with anything else important in your life, your finances are worthy fighting for!

XOXO,

Cierra

Love it. Thanks for sharing. We have to get back on track with being more intentional about our budgeting and spending.

LikeLiked by 1 person